Yield Farming Myths Busted!

Don’t know much about leveraged yield farming? You’re not alone! Being a new sector, there is not so much information out there, and what you can read may fail to properly explain what is a pretty complex topic.

Luckily, our PembRock Finance experts are here to bust some of the biggest myths, making sure you get the information you need to farm with us safely.

Myth 1 - Leveraged yield farming is more dangerous than regular yield farming

Answer: When leveraging funds to farm, you are indeed staking more crypto with a threat of liquidation by the protocol if your debts outstrip the amount that your initial investment covers.

Both yield farming and leveraged yield farming can be risky, but this risk can be significantly lowered depending on the research you do on the projects and the coins you choose to farm, and whether you monitor and adjust your position according to current market conditions.

Myth 2 - Lenders can be liquidated

Answer: Lenders cannot be liquidated. As stated in our first myth, liquidation is a process the protocol undertakes to make sure that losses with borrowed funds do not outstrip the initial collateral that is provided for leveraging. Using their own funds, lenders on PembRock receive predictable rewards based on the borrowing interest rates paid by farmers.

Myth 3 - Once I open a position, it can’t be altered until I withdraw my funds

Answer: All positions can be monitored and altered; in fact, we encourage this practice! With fluctuations in the market, adjusting a position can prevent liquidation during a temporary market downturn.

Myth 4 - Lenders can be exposed due to the failure of farmers to repay loans

Answer: This is also completely incorrect. We apply conservative liquidation thresholds to ensure that farmers have no choice but to pay back loans, meaning funds provided by lenders are completely protected. Lending rewards are gained as advertised and then auto-reinvested for even greater returns!

Myth 5 - Leveraged yield farming is only good for gaining short-term profits

Answer: This is one of the biggest myths in the yield farming space. Yes, it’s true that some people farm for as little as a day, bank their profits, and then put their money elsewhere, but some of this comes out of fear of a coin nosediving or a lack of trust in the platform they are using. Farming reliable coins means you don’t have to constantly move your funds around, and operating on a secure platform like PembRock Finance means you can safely farm over a longer period of time with your profits auto-compounding!

Myth 6 - You can’t profit from leveraged yield farming in a bear market

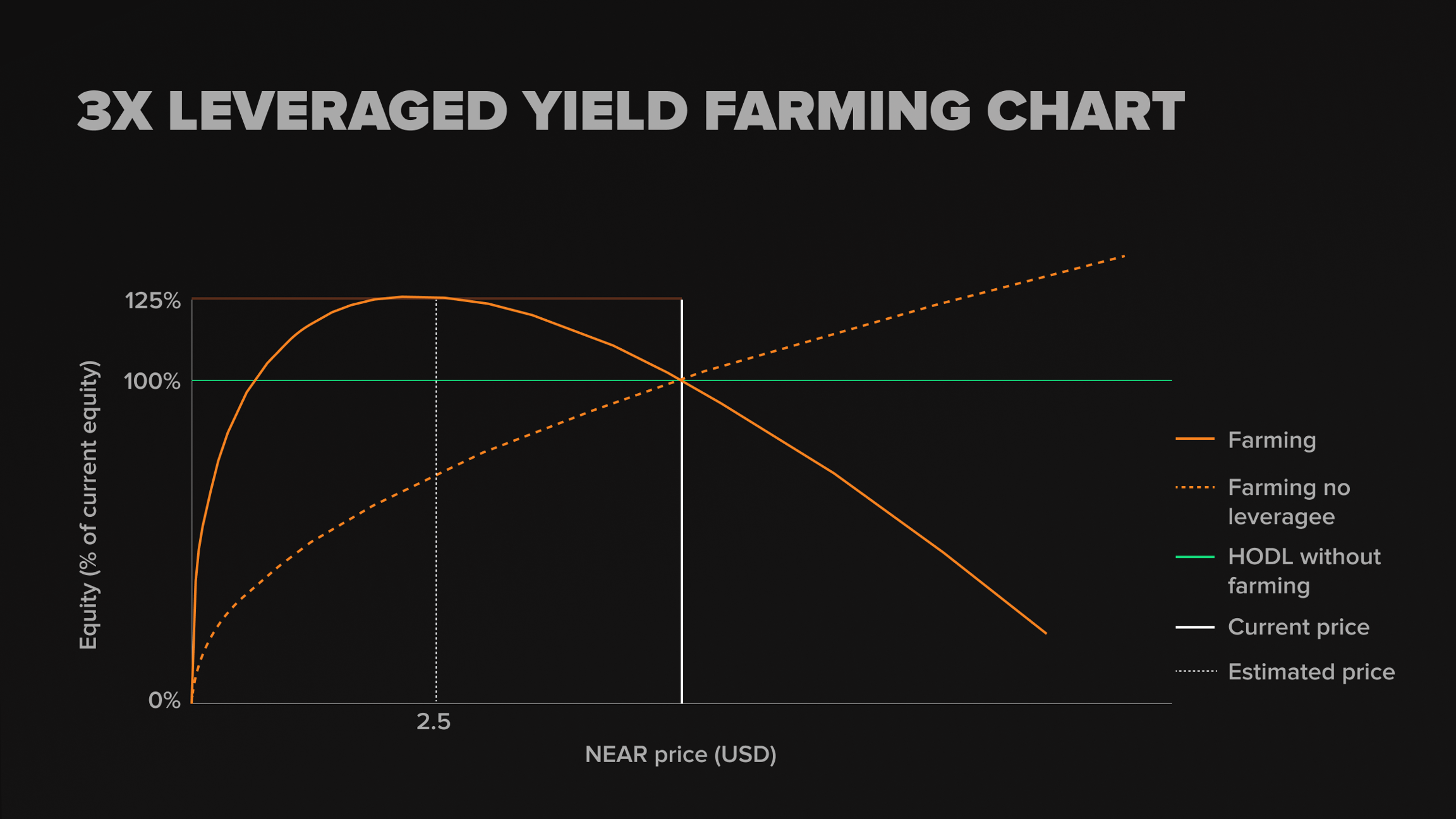

Answer: The great thing about leveraged yield farming is that you have the potential to profit in any market conditions. Below is an example of how even if the price of a coin goes down, you can still profit:

For the purpose of this example, NEAR = $5 USD

You have 1000 USDT and borrow the 400 NEAR ($2000) needed to farm with PembRock Finance with 3x leverage.

Some of the NEAR you borrowed will be automatically converted to USDT to ensure you have a 50:50 value ratio within the pool. Your starting position will consist of 1,500 USDT and 300 NEAR.

In an event where the price drops by 50% (making the price of 1 NEAR $2.50), the pool rebalances to keep the 50:50 value ratio.

Your position will now consist of 1125 USDT and 450 NEAR.

If you choose to close your position, from your initial $1000 principle, you will be left with:

1125 USDT

50 NEAR (your 400 NEAR loan will be paid back automatically)

If you sell this 50 NEAR straight away at $2.50, that will be $125, bringing your total to $1250 — $250 clear profit.

Please also note that you can only profit using this strategy when leveraging by 2x or more.

Last updated